Circularity | Circular Value Chain

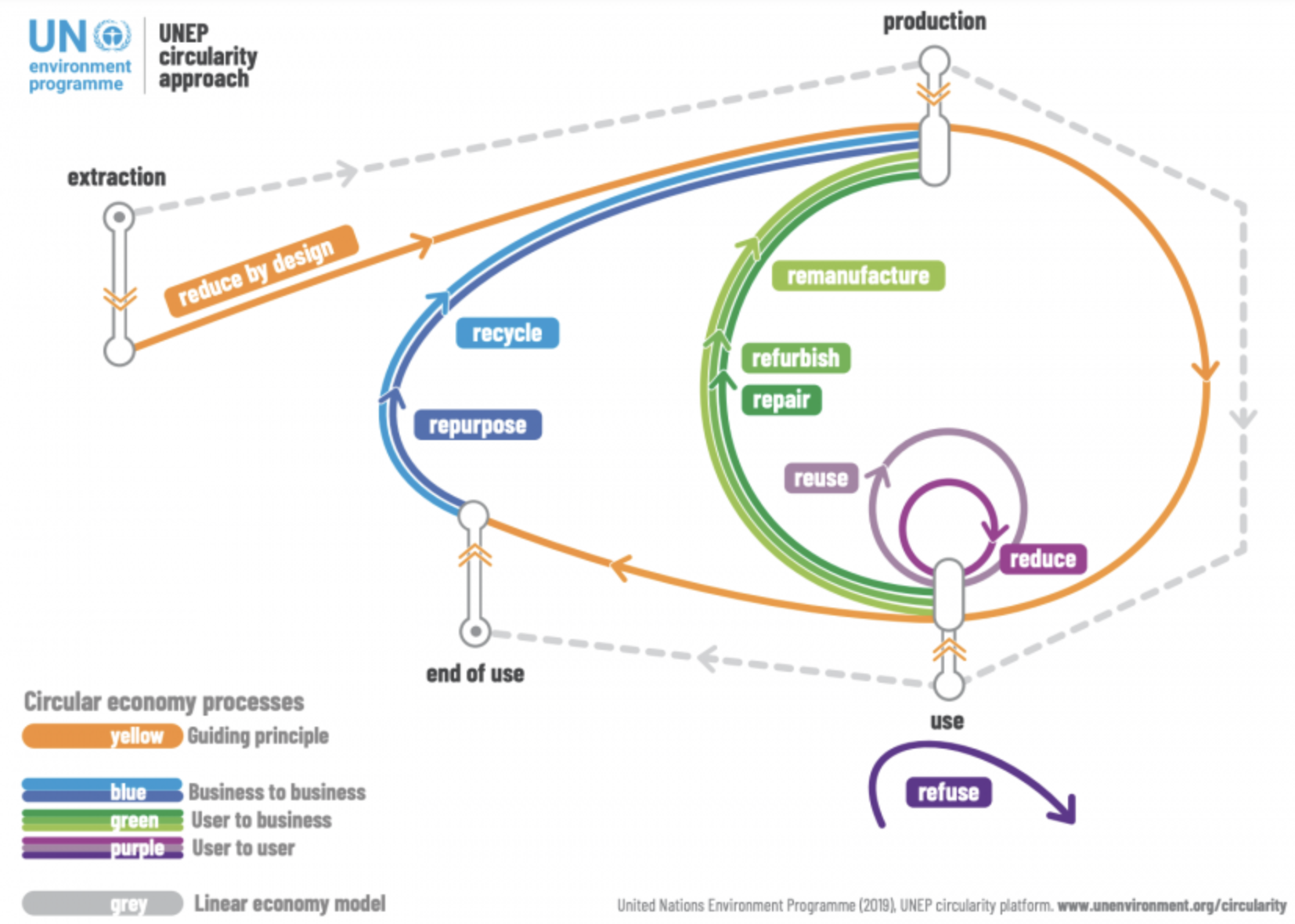

Expanding the value chain concept to the circularity activities can help manufacturers explore new ways to recapture value and rethink their business model. Below is a visual of the Circular Value Chain.

Let’s first see what I mean by Circularity, see why a transition to Circularity is becoming more relevant now, compare the Circular Value Chain to Michael Porter’s original value chain concept and see the implications on business models.

WHAT IS CIRCULARITY?

Circularity is a pilar of circular economy. As the UN Environment Program (UNEP) puts it, it builds upon value retention loops, promoting sustainable consumption and production patterns [1].

At the heart of circularity, products reintegrate the value chain at their end of life. They are either Reused, Repaired, Repurposed, Refurbished, Remanufactured, or Recycled (6R of circularity). In some cases, they may serve restorative or regeneration purposes (in the food or agricultural industries for instance). The main objectives are (1) to reduce the waste that will go to landfill and (2) reduce the pressure on extraction of natural resources.

WHY IS CIRCULARITY IMPORTANT…NOW?

Solving problems UPSTREAM

Circularity invites us to solve problems before they happen. It gives us an opportunity to think UPSTREAM [2]: If you don’t throw plastics to the oceans, you don’t need to clean the oceans from plastics. We need to think ahead and start the revolution by design. We need to choose more durable materials, to transform a supply chain capable to reintegrate products leveraging the 6R (reverse logistics), and to reduce waste by design.

Moreover, circularity could help resolve several problems in one shot: curbing the extraction of natural resources, reducing greenhouse gas emission, avoiding the degradation of natural capital or even avoiding biodiversity loss. I love this infographics from UNEP which shows how impactful circularity could be.

Source: UNEP Platform

New regulations nudging towards Circularity

Governments are exploring ways to promote circularity in their economies with Right-to-Repair laws or Extended Producer Responsibility policies (EPR), for instance.

Extended Producer Responsibility (EPR) is a policy approach under which producers are given a significant responsibility – financial and/or physical – for the treatment or disposal of post-consumer products [3].

When EPR policies become widespread, manufacturers will be forced to transition to Circularity and they will need to manage the end of life of their products, and deal with the consequences for their business model.

THE CIRCULAR VALUE CHAIN

Expanding Michael Porter’s value chain to the new CIRCULARITY activities like REBOUND LOGISTICS (also known as reverse logistics), the 6R activities of the REVALORISATION CYCLE and the WASTE MANAGEMENT activities, the Circular Value Chain can help producers figure out ways to capture more value or even rethink their business model.

For reference, below is the visual for the original Value Chain by Michael Porter (Source HBS online) that can be used to assess the steps that add or subtract value from a product.

Now, below is the visual for the Circular Value Chain, that I have adapted to reflect the activities presented in UNEP’s circularity approach visual. In a circular economy, profits will be computed at the end of the product’s life (i.e. after REBOUND LOGISTICS and WASTE MANAGEMENT) instead of being computed after the fulfillment of the AFTER-SALES SERVICES. Hence, the cost of reverse logistics, the cost of the revalorisation cycle (6R) and the cost of the waste management will be taken into account in profitability calculation.

Eventually, Circularity may affect a company’s business model in the following ways:

burdening the cost structure

transforming the value proposition to the end-customer, either (1) because it may change the interactions with the end-customer, or (2) because it may require different customer behaviors/mindset (perception, attachment, experience)

developing new partnerships across the value chain

change the revenue model by (1) creating opportunities to recapture value through secondary transformations or (2) adaptation, with the objective of offsetting cost increase

SO WHAT DO WE DO NOW?

The transition to circularity is likely to be slow for several reasons, inter alia:

First, rethinking one’s business model is complex, so, companies will likely take time to find out how to adjust to circularity. Also, some companies may just want to wait until they are forced to transitioning to circularity.

Second, the decoupling of the economy will not happen overnight, especially noting that the stock market and the economic growth are tied to the pursuit of more (more consumption, more sales), without computing the cost on the environment nor the social costs caused of the exponential waste that we generate. In a way, the premise of the circularity is to consume less and to produce less in order to respect the planet boundaries, so, it is inconsistent with the current economic dogma. Translating into money terms the impact of damages to the natural and human capital could help curb the tide. In that vein, HBS has been promoting the Impact Weighted Accounts Project [4] so that financials transparently reflect the external impact of business activities but it is not yet mainstream.

Third, regulations will need to create a level playing field that will push for the laggers to take action. The right-to-repair policies and ERP policies will definitely help, for sure. Also, Governments may refrain from pushing the transformation too quickly if it means that their national Champions will suffer under the current economic dogma. All of this go hand in hand.

However, some brands are already exploring ways to include circularity now in their business models, probably for different reasons (reputation, values, opportunistic forays, self-disruption efforts).

To give you examples of what companies are doing now:

Levi’s has created a Second-Hand online shop to resell second-hand jeans, they created Tailor shops in flagship stores to repair or repurpose old jeans, and they have recycled discarded jeans into building insulation with a partner in 2019. [5]

Caterpillar has a brand dedicated to remanufacturing, Cat Reman since 1973. [6]

Apple has been selling Certified Refurbished computers for over 10 years now, they also have a Trade-In and recycling program that pays you money to return your old computers (or iPad or iPhone…) to entice you into buying a new one.

My bet is that the companies that do not start now the transition to Circularity risk being left behind or feeling the sting of disruption when circularity becomes mainstream (i.e. widespread).

Happy to discuss about examples of business model adjustments and ways to decouple the economy.

References:

[1] UNEP: Circularity Approach. https://www.unep.org/circularity

[2] Book: UPSTREAM by Dan Heath Upstream - Heath Brothershttps://heathbrothers.com › Books

[3] OECD: Extended Producer Responsibility https://www.oecd.org/env/tools-evaluation/extendedproducerresponsibility.htm

[4] HBS Impact Weighted Accounts https://www.hbs.edu/impact-weighted-accounts/Pages/default.aspx

[5] Levi’s Use and Renew https://www.levistrauss.com/how-we-do-business/use-and-reuse/

[6] Caterpillar Remanufacturing https://www.caterpillar.com/en/news/caterpillarNews/strategy/ar-remanufacturing.html