How do you […] Impact?

In our prior post, we explained what Impact meant, differentiating it from Sustainability and ESG.

Today, we will unveil the different sauces in which impact manifests itself in a company’s journey towards more sustainable practices… Warning… This is a very long post, skim it first, it’s worth the read.

How do you [assess] impact?

All of our actions generate some sort of impact on our environment and on the people that surround us, may it be positive or negative. As a reminder, when we say that we assess the “impact”of our initiatives, this is a short for “we assess NET POSITIVE IMPACT”. When impact investors screen for the companies in which they will invest, they must find the ones that have business models that will provide returns, along with positive social and environmental impacts. In other words, these business models must create and capture values around activities that will create a change that will be noticeable, and ideally measurable.

Theory of Change

When preparing impactful projects, the first step is to develop a theory of change.

A theory of change serves to make assumptions on (1) what will be changed by our activities (or interventions) and (2) what will be the outputs and outcomes for the beneficiaries and wider universe of stakeholders. In a way, the impact itself is the change in outcomes that derives from these activities, compared to the initial. This theory of change will be tested over time through a process of impact management.

Impact Frontiers gives very clean and easily understandable definitions of outcomes and impact that I like.

Outcome: the level of well-being experienced by a group of people, or the conditions of the natural environment, as a result of an event or action.

Impact: a change in an outcome caused by an organization. An impact can be positive or negative, intended or unintended.

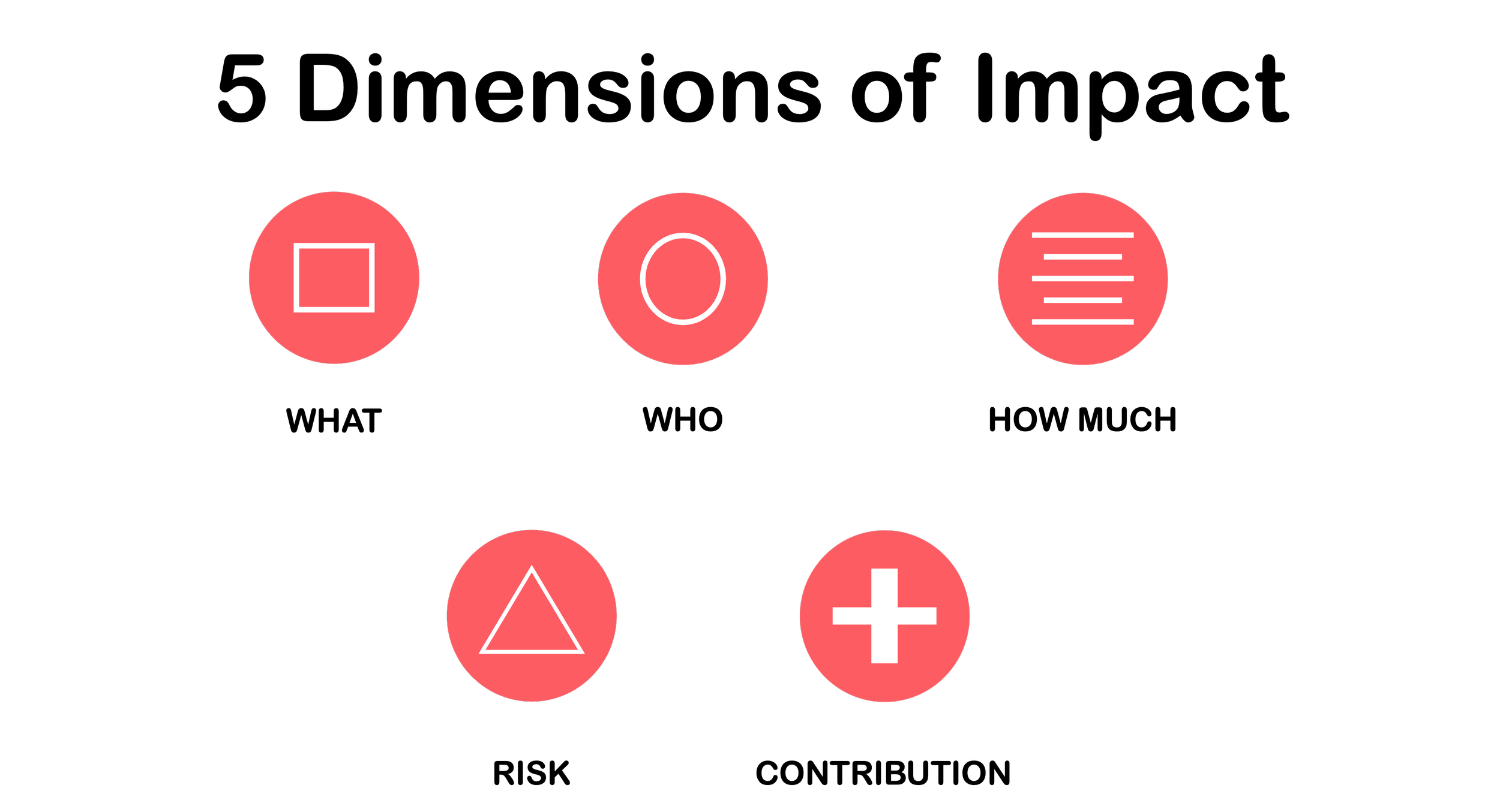

The 5 dimensions of Impact

To further assess the impact, one can describe it across 5 dimensions, as presented by Impact Frontiers. (Note that the image below is inspired from the icons of Impact Frontiers).

WHAT: the outcome

WHO: the beneficiary and affected stakeholders

HOW MUCH: scale of the impact, number of affected stakeholders, degree of change experience and duration of the experienced outcome

CONTRIBUTION: also called “additionally” or “attribution. the contribution of the intervention compared to what would have happened anyway

RISK: likelihood that the impact may differ from expectations

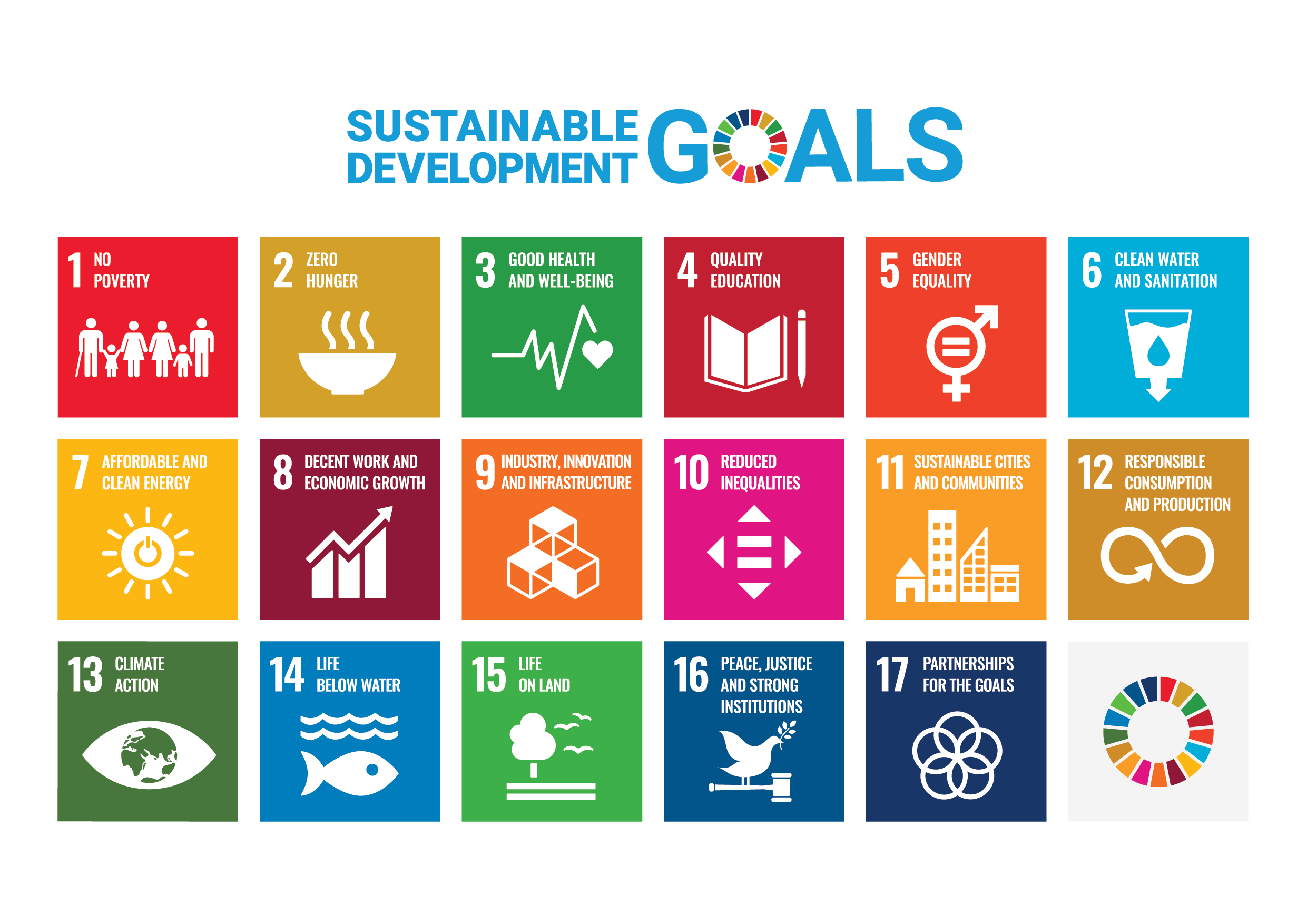

Alignment with Sustainable Development Goals (“SDG”)

When telling your impact story, you can align your impact with the Sustainable Development Goals (“SDG”). It may give you an edge to show how you contribute to a sustainable future in a way that is widely understood. It could be useful to attract capital or partnerships with investors or collaborators who share the same goal. Beware of the elephant in the room, Impact Washing. More on in a future post.

How do you [measure and manage] impact?

Now that we have a better idea of the impact that we may have, it is important to test over time whether or not the intervention delivers the intended impact. It is also important to pay attention to unintended impacts that the intervention may have. To do that, it’s important to follow an Impact Management Framework.

Although there is no standard yet, there is a collaborative platform that is working towards creating a coherent system of impact management resources. It’s called the Impact Management Platform. I’d like to highlight key partners in this initiative: B Lab (who delivers the B Corp certifications), Global Impact Investing Network (GIIN), Global Reporting Initiative (GRI), Principles for Responsible Investment (PRI), Taskforce on Nature-Related Financial Disclosures, and ISO. The International Finance Corporation and the United Development Program (UNDP) and the OECD are notable members of the Steering Committee and co-chairs.

How does an Impact Management Framework Work?

In a nutshell, an Impact Management Framework gives you a standard to measure and manage impact over time. Basically, it requires that you establish ex-ante targets for the outcomes they expect to achieve in the long run, so that they can have a reference to monitor the success of their initiatives over time. You define these targets with criteria and metrics, then, over time you measure the output of your interventions which we call ex-post output. By comparing your ex-ante targets and your ex-post output, you can evaluate whether the intervention achieved the desired results.

There are several frameworks out there. The most well-known are IRIS by GIIN, the PRI framework for investors, the AIMM by the IFC. Development Finance institutions (IDB INVEST, BII, African Development Bank, etc.) have often developped their own frameworks. There are also 9 Operating principles for Impact Management designed for Investors.

Are these models perfect? No. The more we use them, and test their limits, the better we will be at translating impact into intended results.

In practice

In practice, it means that you will need to collect a lot of data to measure your impact. You’ll need to design surveys effectively to be able to measure the intended and unintended impact from the perspective of your stakeholders. As examples, you will probably need to perform lifecycle assessments, start carbon accounting to measure scope 1, scope 2 and scope 3 emissions and stakeholder engagement activities. You will need to partner with your supply chain partners to be able to share and monitor data in a standard way over time. It requires a level of data awareness, data literacy and data preparedness that may require a certain level of digital transformation if you are not ready.

How do you [report] impact?

Again, there is no agreed standard yet but there are several well-known reporting standards:

GRI. The Global Reporting Initiative (“GRI”) has developed standards to demonstrate accountability on the environment, economy and people.

SASB. The Sustainability Accounting Standards Board (“SASB”) standards are designed to standardize disclosure for the sustainability. issues that are relevant for investors’ decision-making.

IFRS S1 and S2. The International Sustainability Standards Board (ISSB) issued in June 2023 the first two IFRS Sustainability Disclosure Standards. The IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and the IFRS S2 Climate Related Disclosures. During COP 28 in Dubai, the IFRS Foundation launched a knowledge hub to build capacity for the ISSB Standards along with partners such as the UN Sustainable Stock Exchange initiative which has 134 stock exchanges members.

TCFD. The Task Force on Climate-related Disclosures had developed specific guidance to monitor the progress of companies’climate-related disclosures, but they have asked the IFRS foundation to take over that monitoring after Q4 2023.

Who does it?

It seems that the sustainability reporting is increasingly done by finance teams in large companies. A lot of capacity building will be required to make sure that finance professionals are ready to apply the chosen reporting standards.

When reporting impact, it is important to distinguish about your organization impacts your world (impact materiality), and how external issues affect your organization (financial materiality). This principle is called “double materiality”.

How do you [monetize] impact?

Being able to monetize impact is a critical challenge. Right now, the financial damages of negative environmental and social impacts are not taken into account in financial reporting that is the basis of stock exchange valuation. Speaking about profit on one hand, and speaking about environmental and social impact on the other hand is like speaking in two different languages. The consequence is that the financial performance of some companies is currently largely inflated because they do not take into account the monetary value of the damages that they cause on people and planet.

From my standpoint, once we overcome the impact monetization challenge or the impact valuation challenge, this Tower of Babel will be broken, it will be a game changer that will make ripples in the stock exchanges. I will point out two promising approaches that are worth considering. Pay attention to them.

Impact Valuation by Valuing Impact

Valuing Impact is a Swiss consulting firm that has developed an impact valuation framework that is absolutely amazing. They quantify the impact on Natural Capital, Human Capital and Social Capital to assess the societal value created by each dollar invested. Their clients include Nestle, Natura, Ikea, inter alia. It’s a neat way to assess the value created by the intended and unintended impacts of your interventions.

I saw their work during my participation to the Oxford Impact Measurement Program last June 2023 and it’s groundbreaking. See a teaser of valuation presented by the visionary Sam Vionnet here.

Impact Weighted Accounts

The Impact Weighted Accounts (IWA) is a Harvard-led initiative that intends to reflecting a company’s true financial, social and environmental performance by monetizing the external impacts caused by the company on people and planet. They provide resources to measure and calculate impact in different industries here.

Conclusion:

Embracing sustainability practices and pursuing net positive impact means embarking on a journey that requires an understanding on:

how to assess impact,

how to measure and manage impact

how to report impact

how to monetize impact

This journey may seem like a daunting task, but it is possible with the help of the right network of advisors and partners. It is necessary to do it well in to avoid the pitfall of Impact Washing, the misrepresentation of the impact made by a company or an intervention. J4Change and its partners can accompany you on that journey, to enable your business transformation towards more impact and more sustainable practices.

#impact