Examples of guarantees deployed by foundations

How can foundations broaden their impact beyond grant-making? One strategy is to use guarantees as part of a strategy to leverage their balance sheet more efficiently, while mobilizing capital from other actors in the finance ecosystem or tackling market failure.

Why guarantees?

Historically, guarantees have been widely used by development finance institutions to mobilize private finance. Why?

First, they typically de-risk investments, which attract financing for projects or companies that would not have attracted such financing or not at the same financial terms (i.e. guarantees may give access to or a lower cost of capital, or to a longer longer term horizon or a higher level of financing than without a guarantee). They allow investors or financiers to become more familiar with the risks associated to a sector or country. There are different types of guarantees, credit guarantees, performance guarantees, etc. Each tackling a different type of perceived risk for an investors, a financier or any other relevant contractual stakeholder in a transaction.

Second, they are capital-efficient because they support projects without immediate cash disbursement.

Thus, this capital-efficient tool has picked the interest of some foundations which have tried to leverage their balance sheet with different strategies to broaden their impact.

3 examples

Here are 3 examples of how foundations have deployed guarantees for catalytic effect. They show how foundations have used innovative finance to expand their impact.

2013: Volume Guarantee

In 2013, The Bill & Melinda Gates foundation, along with other public and private organizations, together the Implant Access Program (IAP), provided a volume guarantee to two large pharmaceutical companies Bayer and Merck and co. Their objective? By providing visibility on the volume of purchase of contraceptive implants for the next 6 years, the volume guarantee would allow the pharmaceutical companies to plan for a higher production capacity, which would lower the production costs of the implants by about 50%. This intervention would affect the supply side, and eventually stimulate the demand side because demand was expected to increase with a decrease of implant costs. In parallel, the IAP provided support for local capacity-building to ensure women would have access to counselors and providers.

By 2015, Bayer and Merck announced that they would expand the price decrease for a longer period until 2023 without additional guarantee.

In 2020, an evaluation of the IAP concluded that the intervention had increased access to implement including “a 10-fold increase in procurement between 2010-2018”.

This example shows how a guarantee can address a form of market failure, rather than the typical example of capital mobilization. More information on this volume guarantee in this paper from the Global Agenda Council on Sustainable Development, World Economic Forum here.

2019: Guarantee Pool for financial guarantees

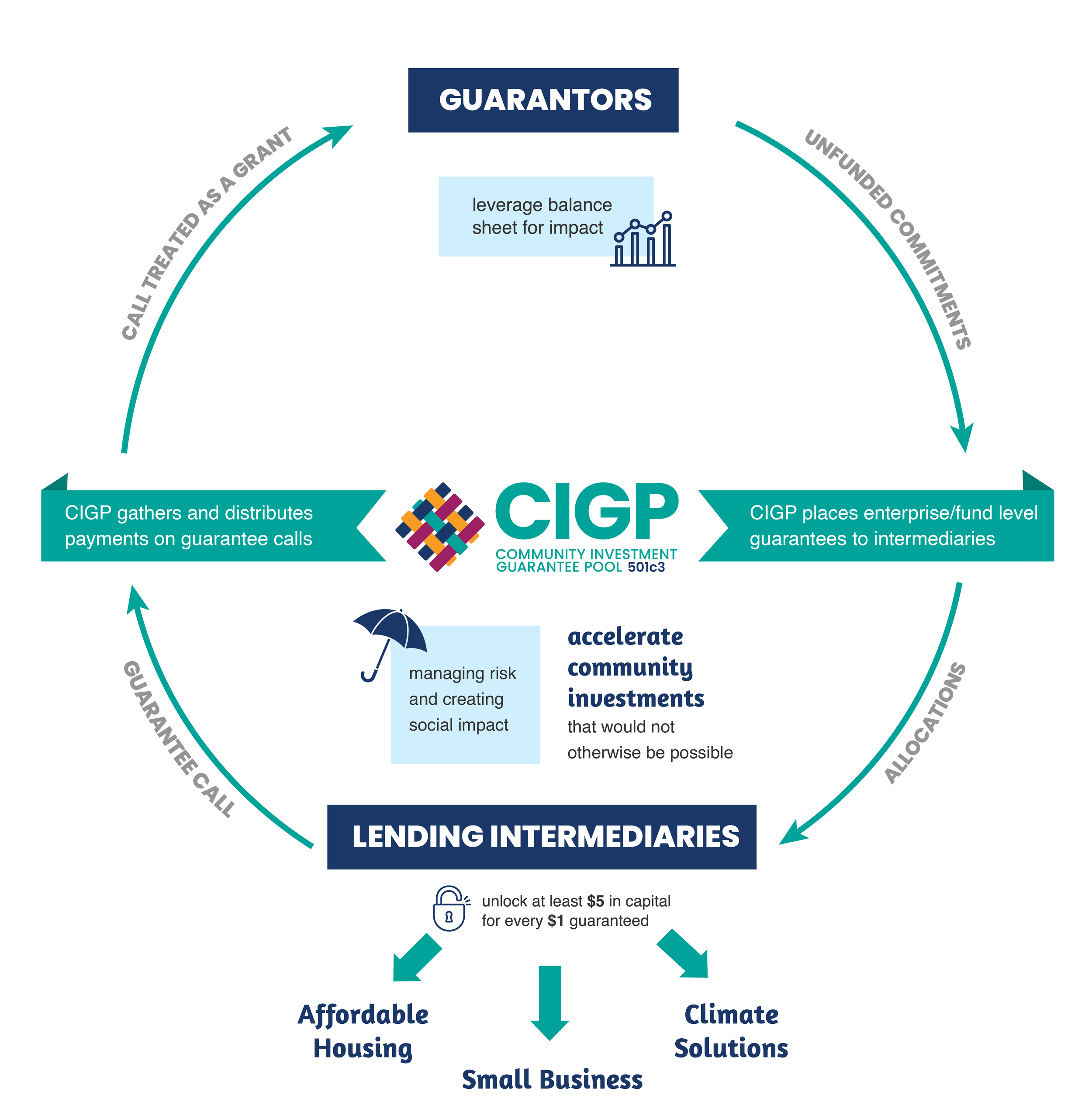

The Kresge Foundation incubated the concept of a guarantee pool called the Community Investment Guarantee Pool (CIGP). This pool was deployed in the US in favor of affordable housing projects, climate solutions and small businesses.

How does the CIGP work?

Several foundations pool their unfunded guarantee commitment through one entity, the CIGP that acts as a clearing house. Then, the CIGP allocates financial guarantees to lending intermediaries. A guarantee fee is charged to the beneficiary to cover the cost of operating the pool. When applicable, the guarantee called is treated as a grant.

According to Kresge’s case study, this vehicle permits to share the risk between foundations and may help overcome challenges that foundations may face if they lack the technical know how or if they lack the necessary back office capabilities.

2023: First Loss Guarantee to catalyze a multi-layered fund

The MacArthur foundation provided a $25M unfunded first loss guarantee to protect FMO, the Dutch development bank which itself provided a first loss reserve of $111M which represented 10% of the total committed private capital for the SDG Loan Fund. The SDG Loan Fund is a blended finance vehicle for a total size of $1.1bn, aimed at funding renewable energy, agribusiness and financial services investments frontier and emerging markets in Africa, Asia, Eastern Europe and Latin America.

Did you see how a relatively small guarantee from a foundation is helping catalyze $1.1bn for the SDGs? According to Impact Alpha, this multi-layered fund structure took over three year to come together.

For more details, check out this Blended Finance Fact Sheet.