Should foundations transition to Impact Investing?

According to this 2024 research by Bridgespan Social Impact, US-based foundations only dedicate 5% of their investments to mission-aligned impactful projects. They typically distribute these funds via grants. Maybe it’s time to challenge foundations to transition to 100% mission-aligned impactful investment by embracing impact investing. The report states that “Foundations endowments exceed $1 trillion, with Donor-Advised Funds (DAFs) contributing an additional $200 billion.

Refresher: What is Impact Investing?

Per its original definition by the Rockefeller Foundation in 2007, Impact Investing is a way to deploy capital to align societal, environmental and commercial objectives. The definition has evolved and keeps evolving. The Global Impact Investing Network (the “GIIN”) defines it as “Investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return."

Impact Investing requires developing a theory of change alongside the typical risk and return frameworks that used to informe the investor’s investment thesis. This theory of change implies a certain level of intentionality (making intentional choice on the type of impact you want to achieve), and a focus on measuring the actual impact achieved over time to ensure that the intervention achieves additionality: i.e. a net positive impact that would not have occurred without the intervention.

According to the GIIN, Impact Investment has been gaining traction over the past decade. In their 20222: Sizing the Impact Investing Market report, the GIIN estimated that the worldwide impact Investing market was USD$1.164 trillion, noting that green bonds and corporate impact investing were increasingly prevalent.

Perceived barriers to the transition

In their report “Can Foundations Endowments Achieve Greater Impact?”, Bridgespan Social Impact and Capricorn Investment Group highlight the following barriers to impact:

Beginner’s dilemma: Foundations are fraught with questions like: where do you begin? How do you build an impact management framework? How do you develop the right investment pipeline? How do you screen projects? How do you change your investment policy?

Capacity Limitations: the teams are already stretched as they are. Where can they find bandwidth to change the way they screen projects, and even manage them over time?

Making sense of an increasingly noisy landscape. The definition of impact investing is ever-changing, there are ESG investments, there are responsible investment, there is impact-washing, green-washing, you name it. How do you choose the right product and the right investment?

Concerns about financial performance. Some may worry that impact investing will compromise their financial performance. Yet, the report highlights that “some foundation shave been successful in allocating substantial portions of their portfolio to impact investing” demonstrating that “it is feasible to design portfolios to achieve dual objectives of financial returns and impact alignments”.

Overcoming Barrier 1: J4Change’s Beginner Guide

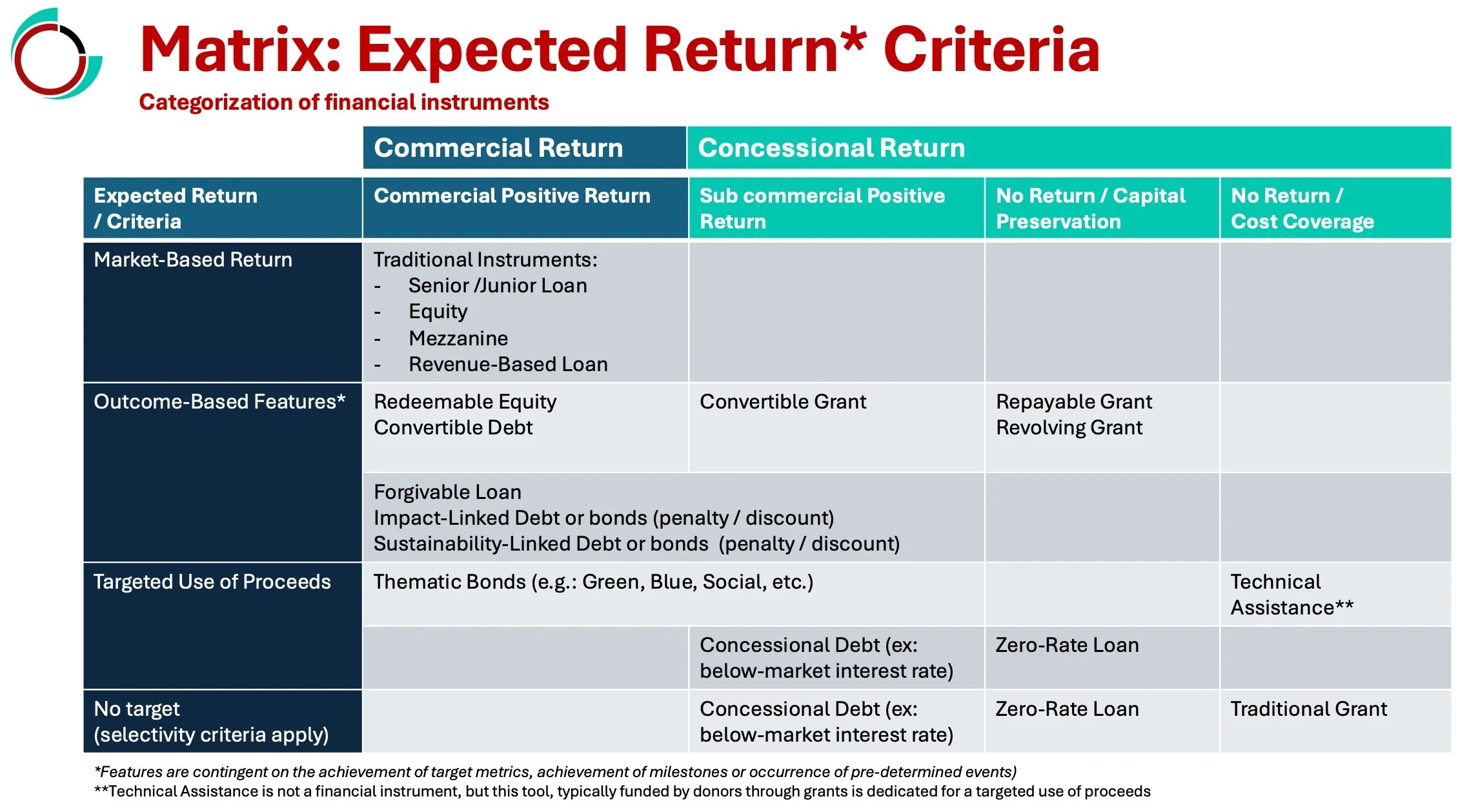

Financial Toolkit for Impact Investing

This guide provides a high level framework to understand the different type of financial instruments, risk mitigation tools and support mechanisms available in impact investing.

It also shades a light on when their use is appropriate depending on return expectations, growth stage or risks being managed.

You can download it here.

Opportunity for collaboration from Proof of Concept to Scale

When it come to social businesses and other impact-aligned projects, the problematic of seed funding is even more prominent than for traditional entrepreneurship, especially when they is a need to complete additional feasibility studies, environmental studies or other social assessments. The existence of patient capital or blended finance vehicles is a game-changer.

- Development Finance Institutions are seeking donors for funds that can offer grants, technical assistance, but also for other types of financial instruments: subordinated debt or concessional debt for high impact projects.

- Multi-donor funds pools funds from different investors to achieve greater catalytic impact.

- There is also a different concept: Venture Philanthropy: the idea that philanthropy can provide capital fro a for-profit mission-aligned business with the objective to participate in the financial upside produced.

Let’s see together how we can move the needle and help scale impact by helping Foundations to shift their strategy to impact investing.